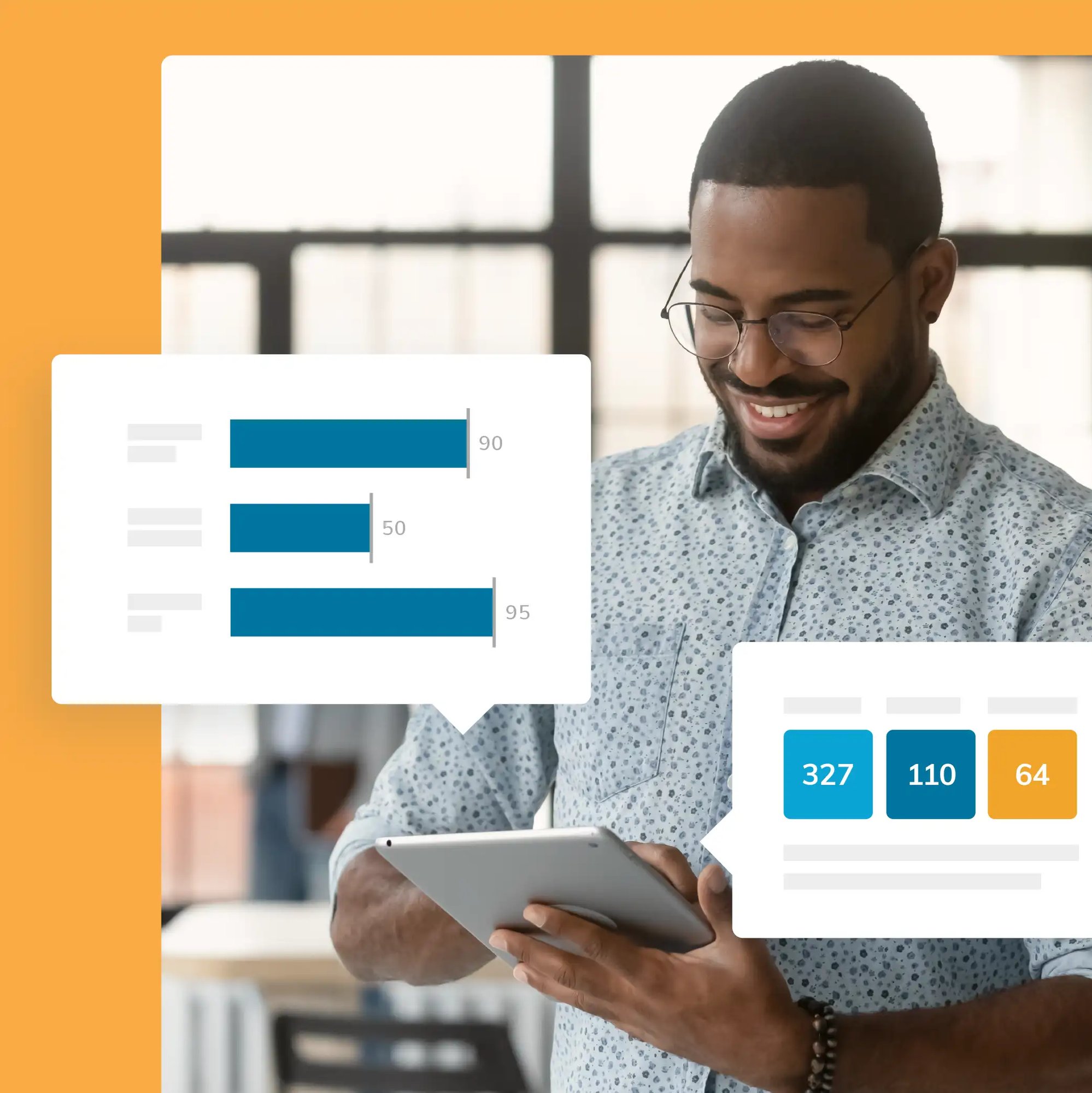

Market Access & Pricing Strategy Focus Groups

Build data-driven pricing strategies and market access plans with stakeholder insights through structured engagements

ExtendMed's Health Expert Connect™ platform enables pharmaceutical teams to conduct sophisticated market access research and pricing strategy focus groups—convening payers, insurers, hospital administrators and other decision-makers to inform market positioning and coverage approaches.